According to the “Chinese Lighting Market Report (2013 version)” released by LEDinside, a research division of TrendForce, the Chinese government successfully passed a series of domestic policies in 2012 that serve to not only stimulate LED lighting demand, but also to strengthen the entire business momentum within the LED lighting market. A few of the key policies worth noting include the proposed spending of 2.2 billion RMB on the promotion of CFL and LED lights. Bans on the sales of 100 Watt-and-above incandescent light bulbs, along with those of halogen lamps whose efficiency levels fall below required standards, took effect on October 1st, 2012.

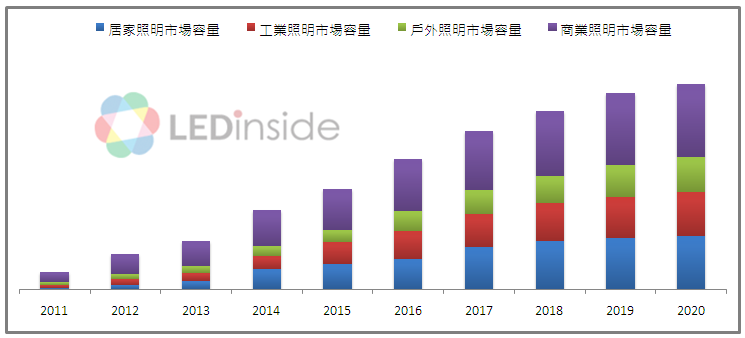

With the general demand for traditional lighting replacement, both LED-based and energy-saving lighting items are expected to gain significant momentum. LEDinside has attempted to measure Chinese LED lighting market value by formulating a model based on the original demand for general luminous flux and the replacement demand for LED-based lighting. As a means to ensure as much prediction accuracy as possible, factors such as China's domestic economic growth and the factors to raise LED lighting penetration rate in China were also taken into account. LEDinside has forecasted that by 2015, the Chinese LED lighting demand will rise up to as high as $US 10 billion. Assuming the country is successful in maintaining its economic growth and increasing LED lighting popularity, the demand value is likely to reach a staggering US$ 22 billion in 2020.

Despite the large, huge scale of China’s LED lighting market, different marketing channels are expected to exert different impacts on the various production life cycles of LED lighting products. While China’s LED industry development is at present still known to be dependent on engineering projects and bidding projects, the situation is expected to change for the better if more and more LED lighting manufacturers deeply develop their business channels and tradition lighting manufacturers generally use LED luminaires. As indicated by LEDinside, through the help of online and physical sales channels, the popularity of LED lighting products will ultimately be greater now than it has ever been in the past. In time, LED lighting is expected to break away from the confines of its segmented market and be able to reach a wider, broader audience in China.

To get more details on the various trends and movements within Chinese LED lighting market, please refer to LEDinside’s “Chinese LED Lighting Market Report: 2013 Version”

Chinese Lighting Market Report -2013 Version

Chapter 1 Chinese Lighting Market Development Forecast

- Introduction

- Section 1 Chinese Lighting Market Value Forecast

- Section 2 Chinese Lighting Export Analysis

- Section 3 Chinese Lighting Market Demand Forecast

- Section 4 Major Chinese Luminaire Manufacturers

Highlight: Revenue Scale, Capital, Product Segment, Market Segment, Company Profile, Business Status, Revenue And Profit, Product Mix, Yankon Lighting, Foshan Lighting, Changfang Lighting, Kingsun Lighting, Cnlight, Nationstar, Honglitronic, And Feilo Acoustics

Chapter 2 Chinese LED Lighting Industry Policy Support And Regional Development

- Introduction

- Section 1 Major Chinese Government Polices To Support the LED Lighting Industry

- Section 2 LED Promotion and Implementation Plans in Various Areas

Chapter 3 Analysis of Lighting Market Segments and Channels

- Introduction

- Section 1 Chinese LED Sales Channel Pricing Strategy Analysis

Highlight:

1. LED Lighting Channel Ratio And Trend Forecast

Internet Channel Supply Chain Survey- Channel Introduction, Launched Product Specifications, Retail Price And Analysis

JD.com

Taobao.com

China.alibaba.com (1688.com)

2. Store Channel Survey

Survey On Product Prices And Specifications In Retail Stores

3. Distribution Channel Survey

2012 LED Luminaire Manufacturer Development In Distribution Channel

Dealer£¯Direct Sales Store £NVC

Analysis and Conclusions:

- Section 2 Commercial Lighting- Retail, Hotels, Office Lighting and Entertainment Lighting

- Section 3 Residential Lighting

- Section 4 Industrial Lighting

- Section 5 Outdoor Lighting

Highlight:

LED Product List And Market Field

Environment And Request

Channel Analysis

Chinese LED Market Segment Analysis

Major Manufacturer Overview

Chapter 4 Chinese LED Lighting Supply Chain Overview

- Introduction

- Section 1 ODM / OEM Supply Chain International Lumainire Manufacturers

Highlight: Philips¡¢Osram¡¢GE¡¢Toshiba¡¢Sharp¡¢NEC

- Section 2 Basic Requirements For Entering the ODM / OEM Supply Chain

- Section 3 Case Analysis and Discussion on ODM / OEM Projects And Conclusions

Chapter 5 Major Energy Management Business Models For LED Energy Saving Project

- Section 1 Energy Management Contract (EMC) Model

- Section 2 Build and Transfer (BT) Model

- Section 3 EMBT Model

Chapter 6 Analyzing Characteristics And Cost of LED Lighting Products

- Introduction

- Section 1 Analyzing The Features Of LED Lighting Products

- Section 2 Analyzing The Key Materials Of LED Lighting Products

- Section 3 LED Lighting Products BOM Cost Analysis

Highlight: 40W Equiv. LED Lamp, T8 Light Tube, 100W LED Street Lamp, 12W PAR30, And 5W MR16

- Section 4 LED Energy Saving- Case Analysis

Chapter 7 Lamp Accessories and Major Manufacturers Overview

- Section 1 LED Driver IC Development Situation and Major Manufacturers

- Section 2 LED Power Supply Development Situation and Major Manufacturers

- Section 3 LED Lighting Thermal Module Development Situation and Major Manufacturers

Chapter 8 Investment Suggestions and Trend Analysis

- Introduction

- Section 1 Suggested Investment Strategy

- Section 2 Trend Analysis

Published Date: June 30, 2013

Language: English

Format: Electronic File (PDF)

Page: 229

If you would like to know more details, please contact :

| Taipei: |

|

|

|

Joanne Wu

joannewu@trendforce.com

+886-2-7702-6888 ext. 972 |

|

|